America Has a $15 Trillion Problem. Make Sure It’s Not Your Problem

There’s some bad advice out there about paying off debt. Jared shows you the best way to eliminate debt and recover your financial freedom.

Your Most Critical Financial Task of the Year

Everyone needs an emergency fund. It’s more important than investing, and believe it or not, it’s more important than paying down debt. Find out how much you need and why.

Here’s a $200 question for you…

How much money do you need to make before you fly first class?

It depends on your income level and net worth—that goes without saying. But it also depends on how long the flight is, whether you can fit comfortably in coach, and whether or not you’re traveling for business.

Like a lot of people, I usually work on flights, even if it isn’t an official business trip. So, even if I only have an hour, I can get more done, and do it more comfortably, if I’m flying first class.

You also have to factor in the amenities. You get to check your bags for free with first class tickets. You also get to choose your seats, board first, and in some instances, you might get lounge access. Those amenities are worth something.

Myrtle Beach to Nashville

I flew to from Myrtle Beach to Nashville recently, with a layover in Charlotte. And when I pulled up the flights, coach tickets cost $300 and first class tickets cost $500. So, the difference was only $200.

This was a business trip, and therefore a business expense. And because of that, the extra $200 was really only an extra $120. So, for me, it was a no-brainer. It’s just a much better experience.

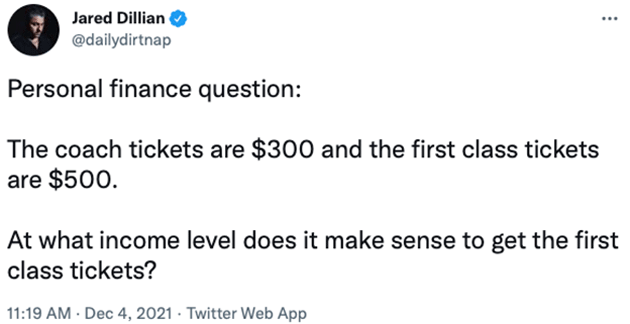

But I put the question to Twitter. (By the way, you should follow me on Twitter.)

Source: Twitter

All things being equal, how much should you make before spending that extra $200 on first class?

If you make a million dollars a year, don’t even think about it—just get the tickets. And if you make $300k–$400k a year, it’s something you can splurge on sometimes.

For most people, though, $200 feels like a lot of money. If you make $60,000 a year, it’s about a day’s work. And if you lose your wallet with $200 cash in it, you would probably be pretty upset about it.

Even so, $200 is also just one trip to the grocery store, or one trip to Target. It’s not nothing. But in the grand scheme of things, it’s not that much money, especially if it’s a very occasional expense.

Here’s another way to put it in perspective—if you have an average, $300,000–$500,000 house, the interest on your mortgage is going to be $900–$1,000 a month. So, it all comes down to your mentality…

Choose Your Luxuries

We talk a lot about how the big things move the needle—the house, the car, the student loans. I would even say that travel is one of the big things. But a $200 expense, once a year or so, for someone making $300,000, is not going to make a dent. It’s a small luxury that someone in that income bracket should choose from time to time.

Now, I can afford first class by any measure. But I fly a lot, and I often fly coach. Or I buy a coach ticket, and I get upgraded. But in situations like these, where the upgrade is only $200, I just pay for it.

International flights are a different story…

The best time to fly first class is on an international flight, when someone else is paying for it. I did that when I was at Lehman Brothers, and it was amazing. But when it’s coming out of your own pocket, and the first-class ticket is an extra $8,000, that is a lot of money.

Long flights are miserable no matter what. And I just cannot bring myself to spend an extra $8,000 to be miserable for 12 hours. In some ways, I’m still a CF at heart.

Jared Dillian

|

Benefit from higher rents (without buying a rental)

Everyone knows housing prices are soaring. So, how can you profit from rising real estate prices without buying a rental property?

Happy Pigs Means Pricier Bacon

Inflation keeps roaring. In November, the Consumer Price Index, the go-to measure of inflation, rose 6.8% year over year.

Here’s Your Vacation Budget. Go Somewhere

Most of you know I hate budgets. But they serve a purpose, and today we are going to look at how much you can spend on travel.

‹ First < 23 24 25 26 27 > Last ›